Welcome to America, the home of “credit”. In my opinion, if cash is king then credit is an emperor in America. Having physical cash can get you so far but having credit opens many opportunities to you. Here is a simple experiment, go to any of the hotels in your area to book a room, ask to pay in cash and see what happens. More often than not, they would want to have a credit card for the transaction. So as a new immigrant, you will have to learn to understand and embrace this culture of credit in America.

What is Credit? Who maintains the credit report and calculates the score?

- Ability to have access to goods and services with the understanding that you will pay later. It may be a credit card or access to loans. There are 3 credit reporting bureaus : Equifax, Experian and TransUnion, they are non-governmental agencies responsible for maintaining credit report and calculating the credit score of all Americans.

What is a credit score?

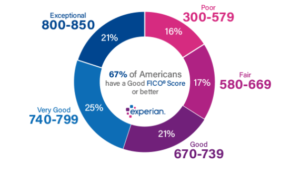

- It is the measure of your “credit worthiness”. It basically determines whether you are a high risk or low risk borrower. A good credit score means you are a low risk borrower but poor credit score means you are a high risk borrower.

Why is it important?

- Loans

- Your ability to secure loans such as auto loan, personal loan, mortgage loan are determined by your credit worthiness. A poor credit may disqualify you from getting approved for certain loans.

- Interest Rates!

- Having a good credit can offer you benefits such as low interest rates but a poor credit could put you at risk of high interest rates if you do get approved for a loan or a credit card. Example: Person A goes to an auto dealership to buy a 2022 VW Atlas but your credit score is 720, which is good so you get approved for an auto loan with 9% interest rate for 48 months. However, Person B with 810 credit score get the same car at an interest rate of 3% for 48 months.

Person A ends up paying $ 2,415.48 in interest

Person B ends up paying $797.17 in interest

Person B saves $1,618.31..That’s the impact of credit!

- Some jobs may require it as a condition of employment.

- Having a good credit is necessary for some jobs such as military, law enforcement, prison jobs, attorneys etc. Imagine the horror if criminals could influence our law enforcement officials with money. Our justice system is not for sale so to maintain the integrity of our judicial system, all the people connected to it are expected to be held to a standard where they can’t be influenced by money.

How to you build a credit as a new immigrant?

You can start with cellphone account

- most cellphone plans do not require you to have a credit history or score, so this will be a good starting point.

Open a bank account where your paycheck gets deposited

- Most banks offer their customers credit cards after you have been with them time, you bank will offer credit cards to you

You can use credit builder loan accounts to help you build your credit.

- A Credit builder loan account allows you to make monthly payments to be held by the bank or service provider and at maturity, you will get the money you paid back minus administrative fees. These monthly payments will be reported to the credit bureaus and missed payments will also be reported to the credit bureaus as well.

Pay rent

- Some apartments report rent payments and missed payments to the credit bureaus. Making your rent payments on time and consistently could help boost your credit score

How do you lose or gain points?

- Payment history

- Making on time payment of bills and not missing a payment goes a long way to increase your credit score points. Doing the otherwise will cause you to lose point resulting in decreased score.

- Credit Utilization

- It is a percentage of how much credit you have used versus the total credit line. Having a higher credit utilization will have negative impact on your credit score and vice versa. The goal is to maintain a low credit utilization percentage so that you can gain points.

Example; if you have $1500 credit limit, keep the rolling balance under 20%. This will show other lenders that you have your spending under control and they can trust you with even more.

- Length of credit history

- It is the amount of time you have held that credit account for. This may go against a new immigrant since you are starting from scratch. But one way to overcome this, is to be an authorized user on an older account of someone who has a good credit score. This will help boost your credit history. Similarly, a negative activity by that user could impact the authorized user. Been an authorized user does not necessarily mean you should be given a credit card on that account.

- Credit mix

- Having varied credit accounts such as credit cards, loans, etc., help boost your credit score.

- Recent application

- Every time you apply for a new credit card or loans, the lender performs a “Hard pull” on your credit report. This hard pull could result in loss of 5 points or more on your credit score. So, it is a good idea to not have as many hard pulls and avoid unnecessary credit applications that may result in hard pull. A hard pull may stay on your credit report for 2 years.

- Derogatory information

- This may be the result of having multiple nonpayment or an account going into collection. An account goes into collection when the original creditor/lender has been unsuccessful in collecting payment on a bill. And so, the lender sells the account to a collections agency which will attempt to collect the payment. Try and negotiate with the original creditor/lender to come to a flexible payment plan before your debt goes into collections. A collections action against any of your accounts could impact your credit for 7 years.

How do you check your score?

- You can use websites such as Annualcreditreport.com to check your credit report.

Please follow us on all social media platforms for great content.